Are you showing enough love to your (mobile) customers?

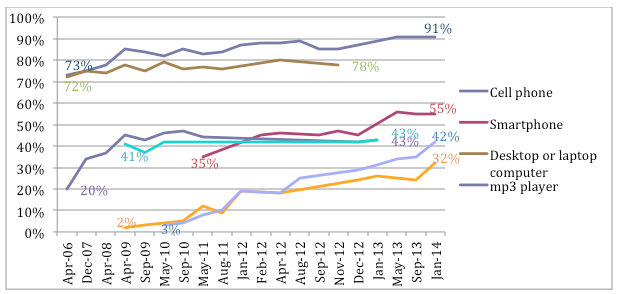

Do you know where your customers are? According to Pew Research, they are on their smart phones and tablets. And those “smart connected devices” continue to replace desktops and laptops: worldwide PC shipments in 2013 were down 10 percent from 2012.

Smart phones are only becoming more integral to everyday life:

- 91% of American adults have a cell phone.

- Of these, 55% are considered “smartphones.”

- The cellular phone is the most quickly adopted technology in history.

- 29% of users describe their phone as something they can’t live without.

- 42% of American adults own a tablet computer.

So what does that mean for financial institutions? Mitek, the company that introduced remote deposit capture technology for mobile banking, uses the built-in camera in these devices to snap images in lieu of keystrokes – giving users the ability to digitize data without having to type it in little bitty boxes. Soon, customers will be able to open new accounts directly from their phones or tablets by taking a photo of the front and back of their driver’s license.

The next step will be shopping mortgages and credit card rates by snapping a picture of your statement and emailing it to find the better deal.

Another upward trend: 34% of all users are “mobile only,” meaning they use only their mobile devices and have no other computer or telephone (up 9% from 2012).

Not only is cellular the most quickly adopted technology in history, it’s the most rapidly evolved.

Do you remember lugging around a bag phone (my first “mobile” phone) and having to roll down your car window so you could attach an antenna to the roof? We watched the demise of the pay phone from the temperature-controlled comfort and safety of our cars. And we watched as our means of mobile communication became more affordable, sleeker, powerful and feature-filled in the span of little over a decade. Once you experience that level of convenience, there is just no going back. As this technology continues to evolve to the point that mobile devices become the new personal computer, how does it affect financial institutions?

Your Mobile Strategy needs to be as responsive and fluid as emerging technology itself, not just a one-off project so you can check “mobile presence” off your to-do list. Does your mobile offering include useful features your customers need and want? How does it compare with your competitors? Is your mobile platform robust enough to handle 24/7 access or unexpected growth? How secure is your mobile experience for your customer?

Long gone are the days when consumers only used their mobile devices to game, tweet, pin and check in. Now users live online with their smart connected devices to consume, bank, document their vacations as well as book them.

Financial institutions will need to be where their audience is – on their phones and tablets. And that banking experience must be as easy to use, pleasant and convenient as all the other digital distractions just a tap away.

Can you hear me now?

Beth Kitchings, Account Supervisor at The Ramey Agency

Beth Kitchings, Account Supervisor at The Ramey Agency