Affluent consumers enthusiastically consume traditional and digital media.

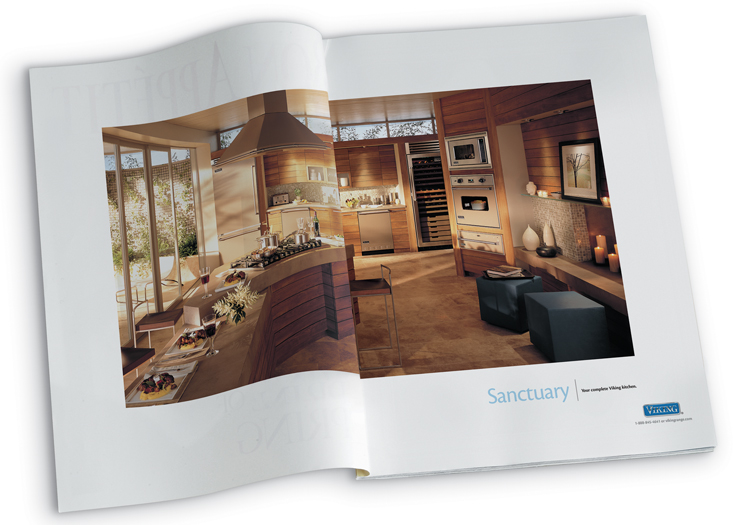

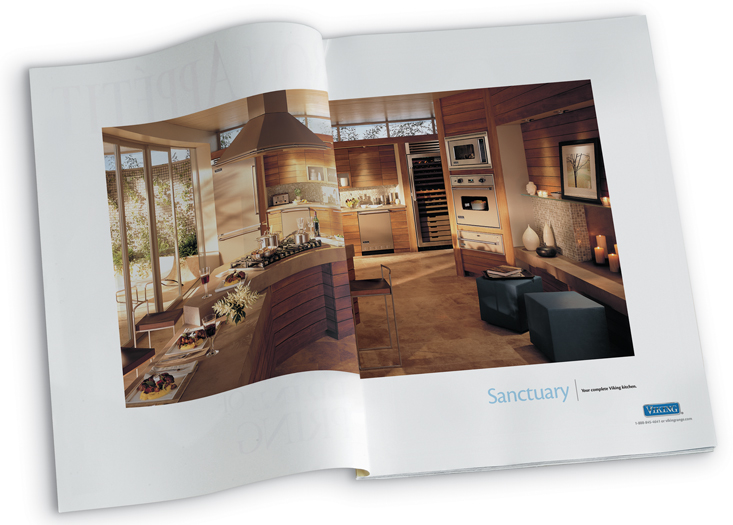

Marketers of high-end home brands had to make difficult decisions during the economic recession. When revenues fell, so did marketing budgets – and that often meant that media was dramatically cut. More than once, a CMO told me that they were facing a sort of “either/or” crisis. They could afford either traditional media or digital, but not both. And since digital provided better tracking and analytics, that’s usually where they invested their dollars. That was not necessarily the wrong decision – they had to do what they had to do – but sometimes their decisions were influenced more by internal pressures rather than hard data.

The facts are that affluent Americans have remained ardent consumers of both traditional and digital media – and that trend continues, even as the economy continues to improve.

The 2013 Ipsos Affluent Survey USA (formerly known as the Mendelsohn Affluent Survey) details the lifestyles and media habits of high-earning individuals. While digital media consumption continues to grow dramatically, its growth doesn’t appear to be at the expense of traditional media, such as print.

According to Ipsos, “81% of Affluents read at least one of the 142 reported print publications (135 magazines and 7 national newspapers); coupled with the growth of the Affluent population, the number of Affluents who read a print publication rose to more than 50 million.”

Moreover, print readership skews higher as income rises. Affluents read 16.7 issues from 7.4 different titles, but Ultra Affluents ($250,000+ HHI) read 22% more titles and 29% more issues. The skews are even more dramatic among Wealthy consumers ($500,000+ HHI), who read 45% more titles and 62% more issues than Affluents.

As revenues rise and marketing budgets get replenished, marketers of high-end home brands need to keep in mind this “both/and” behavior as they build new campaigns. Dr. Stephen Kraus, Chief Insights Officer for the Ipsos survey says,

“Affluents’ growing digital media use tends to supplement – rather than replace – their traditional media use, and the result is real growth in their engagement with media as a whole.”

For more information about The 2013 Ipsos Affluent Survey USA, which includes a summary infographic, click here.