Be wary of a “one size fits all” marketing approach.

Too many marketers believe that affluent consumers behave alike – when in fact, they are as diverse a group as the general population.

Researcher Bob Shullman has written, “There are significant differences on many issues depending on their household income, wealth, age, and gender. These differences present both a challenge and an opportunity to marketers in tailoring their messages, rather than using a ‘one size fits all’ approach.”

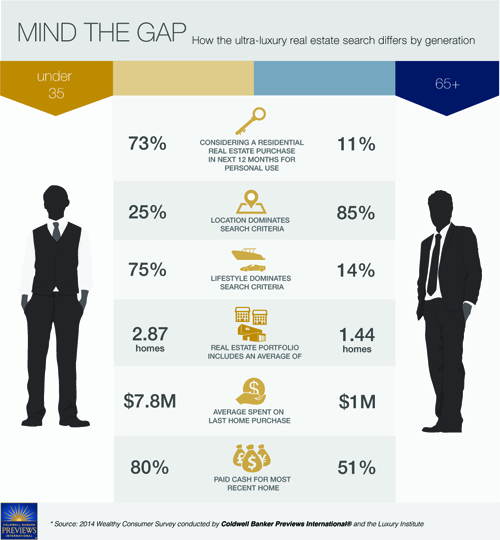

A recent study from the Luxury Institute and Coldwell Banker Previews International demonstrates just how diverse affluent homebuyers can be. Surveying more than 500 ultra-wealthy U.S. consumers with a minimum net worth of $5 million, the report highlights a dramatic generational difference in perspectives among affluent consumers.

For instance, 73% of Affluents under 35 are considering a residential real estate purchase for personal use during the next 12 months, compared to only 11% of Affluents over 65. You might think that this statistic makes sense, given the fact that many Americans in this younger age group are starting families.

But another surprise is that the younger group spent $7.8 million, on average, on their last home purchase, compared to only $1 million for the older group. Or that the younger group owns 2.87 homes in their real estate portfolio versus 1.44 owned by the older group. Those are pretty stark differences.

The most surprising trend to me was a new challenge to the age-old maxim of location, location, location. While the vast majority (85+%) of buyers 65 and older say that location is the most potent driver of their next property search, the under-35 buyers are dramatically more focused on lifestyle, rather than location.

“While location and price remain the most important elements in the decision making process, younger affluents are less inclined to choose a property based on geography,” wrote the report’s authors. “Thanks to convenient travel options and the ability to work from anywhere becoming more widespread, just 25% of the under-35 group reports that location dominates their search criteria, but 75% say that lifestyle considerations drive their choice of which home to buy.

Are sales of your brand evenly distributed across the age spectrum? Or does one age group skew higher? More importantly, does one age group represent more potential for your brand? These are important considerations for marketers, given the fact that the perceptions and buying habits among these consumer groups can vary so dramatically.

You can read the report here and here.

One thought on “The Dramatic Differences Between Younger and Older Affluents”