Seven out of ten of your prospective buyers over the next few years don’t know your brand. What are you doing about it?

Over the past few months, we’ve been paying attention to a generation gap that is barreling toward us at a faster rate and at a greater intensity than we’ve seen historically.

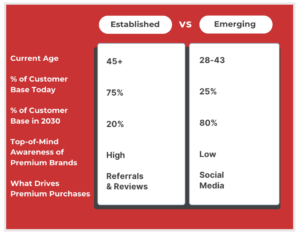

In multiple research studies for clients across several verticals – ranging from premium home brands to the utility sector – the trend seems to be a younger emerging consumer who thinks, behaves, and buys in such a dramatically different fashion compared to the existing consumer. This will require companies to take a radically different marketing approach if they want to survive.

I recognize that this is a bold claim, but bear with me, and hopefully you’ll see that I’m not being dramatic…

Earlier in the year, we saw several data points that suggested working Millennials will account for as much as 55% of the global luxury market by 2030, with Gen Z consumers capturing an additional 30%. With these younger generations projected to hold the lion’s share of purchasing power in a few short years, we wanted to dig deeper and to understand what the implications might be for these brands.

So for our next step, we commissioned some proprietary research to explore this trend even deeper in the high-end home category. When we saw the results, the immediate “aha” that came to mind was the Dan Sullivan quote: “what got you here won’t get you there.” Turns out that too many companies are relying solely on their established buyers. In the home category, we’ve seen flat to negative growth over the past couple of years – and much of it has been attributable to inflation, the interest rate environment, and affluent consumers (who spend up to 5x more on home-related purchases compared to the general population) deciding to sit on the sidelines.

I’m not discounting any of these factors, but I would also add that too many companies are focused on their established buyers at the expense of their emerging prospects – and I believe executives may soon discover that they’ve reached their ceiling on established buyers.

With the election now behind us, we agree with the forecasts that there is potentially a great deal of pent-up demand that may be released in the first half of 2025, especially if rates continue to inch downward. But brands will need to prioritize getting to know the emerging consumer, meeting them where they are, and building a relationship with them that will look dramatically different than what you’ve been used to.

Among premium home brands, this likely means a deeper dive into social than you are currently doing, since nearly 9 out of 10 Millennials use social media in their decision-making. Those longer form videos on your YouTube channel need to be completely revamped into shorter, bite-sized pieces. And while your existing consumer may value your products for quality, the emerging affluents are more interested in products that promote their status and self-expression.

This, of course, assumes that you know how to reach them. Let’s say that you only have a small database of emerging affluent customers. We are doing more and more work taking limited first-party customer data – and doing lookalike modeling to find more prospects who share similar demographic and psychographic characteristics. This information helps inform our content delivery strategies and helps us with A/B message testing and real-time media optimization.

As one of our research partners, Mintel, points out: premium brands “will be challenged to meet the needs of both affluent traditionalists and the emerging consumer, requiring a balance between an exclusive and prestigious past and a more innovative future.”

Ironically, we’re seeing a similar pattern emerge in a completely different category: the utility space. We’ve worked alongside investor-owned and municipal utilities and related companies in the energy sector for more than 15 years – and we have identified a strong correlation: those utilities who have built strong brands drive higher customer satisfaction, which leads to more successful regulatory outcomes.

Said another way, proactively building solid marketing communications can go a long way toward winning rate cases and strengthening the grid. Research from the Oliver Wyman Group notes “utilities that are better at providing a good customer experience and building a strong brand deliver long-term return on equity (ROE) about 1.7 percent above the rest of the pack.”

Unfortunately, among all segments of customers, only the older, more established segment typically scores their utility with the highest degree of satisfaction. Care to guess which segment scores their utility with the lowest degree of satisfaction?

We’ll see the more sophisticated utilities begin to build a segmentation approach for their customer communications, such that they can deploy targeted messaging that specifically addresses the customer’s needs, in a highly targeted deployment. I believe that this one workstream will begin to separate the winners from the losers, especially in the investor-owned utility space.

For our clients who are facing this seismic shift in purchasing power from their established customer base to their emerging prospects and customers, we are beginning the work of building custom campaign messaging and content delivery tracks for each group. This will ensure that our clients are well positioned to thrive when these younger consumers own the majority of purchasing power.